Navigating the Decline: Opportunities Amidst Small Business Challenges – 2023.09.13

September 13, 2023 | Business Development, Government

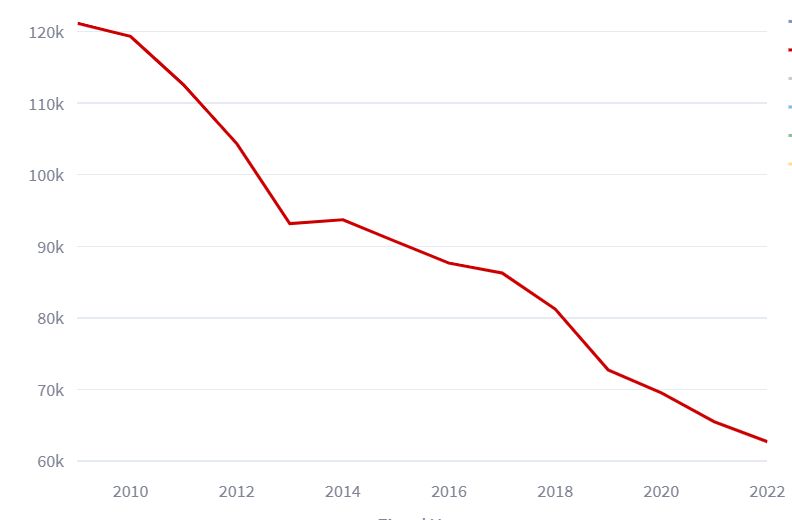

Image Taken from SBA.gov

So, I have to say the post by Steven Koprince last week was super depressing! No offense, Mr. Koprince. I appreciate the awareness you presented of the issue of the Federal Government losing 48% of the prime small businesses since 2009. It doesn’t matter if it’s a presidential election year or midterm elections; we constantly hear from all who are running about how vital small businesses are to the lifeblood of this country. Congress legislates initiatives making it easier for small businesses to access capital, tax breaks, and other programs. At the same time, the Executive branch sets up goals for agencies accountable for awarding a percentage of contracts to small businesses every year. So, with the information Mr. Koprince presented from the Small Business Data HUB, I had to search for some good news because a drop of almost half in small business primes is NOT good news to a small business who wants to pursue Federal contracts as a business decision.

More Data. More Discouraging News

So I decided to look instead at the # of contracts awarded to small businesses instead of large companies and the total dollars awarded to both over the last ten years to see if the story was happier for small businesses than the graph Mr. Koprince showed. It is not. According to the SAM Databank, the number of contracts awarded to small businesses of all kinds has decreased between FY’2013 and FY’2022 by 50%. The dollars obligated for the same period to small businesses did increase, but only by a little over 8%, while the total dollars obligated for all contracts increased by 62%

One Possible Cause

While I believe there are many causes, one important one in reducing small businesses and the number of contracts awarded to small businesses is using contract vehicles to award contracts to companies instead of open market opportunities. As stated earlier, from FY’13 to FY’22, the total number of dollars obligated for contracts by the Federal Government increased by 62%. Not news, of course. The amount of money the government spends on goods is bound to increase. However, the amount of dollars obligated to contracts awarded against major contract vehicles from FY’13 to FY’22 increased by almost 450%. This means that contracting officers no longer compete for contracts on the open market but instead use contract vehicles to fulfill their customers’ requests.

Contract vehicles tend to be a significant barrier for small businesses. One of my small business clients called them a “legal cartel.” I recognize there is not a lot of truth in that statement. However, that is the perception they give some small businesses. They have to develop a proposal complete with a technical response, past performance, pricing, and the terms and conditions of their contract. Then, they have to sell their products like they would in the open market. It is somewhat counterintuitive to the commercial process they know. Furthermore, they often don’t have the bandwidth to create these responses and don’t have the resources to pay someone to complete them. Even if they did, companies that prepare these often don’t help with the sales strategy once they are awarded these contract vehicles.

Other barriers have cropped up as well. They include more compliance requirements from IT to accounting. Some agencies require more security clearances. The government requiring contract personnel to be vaccinated against COVID is an example of one currently. Even the SAM registration process is much more arduous than ten years ago.

Adversity Is Universal In All Business

Regardless of the barriers, there is still plenty of opportunity for small businesses to create another revenue stream by working with the Federal government. I have worked in the Federal contracting industry for almost 20 years now. Conversely, if I were to work in retail or some other business-to-consumer market now, I would feel the barriers to entry would be insurmountable. Furthermore, when something is new and unknown, we tend to fear it, which sometimes leads to jumping to incorrect conclusions. The amount of bad advice doesn’t help people’s perception of doing business with the government. Some say all you need is a minority, woman, or veteran-owned status to get a contract. Others say all you need is a GSA schedule. And when these people get these items and come up empty-handed, it doesn’t help the cause of attracting talented, capable small businesses.

Where Do We Go Next

I see barriers of entry as opportunities for those who want to do the extra work. Yes. There are more hoops to jump through. Yes. The sales cycle is longer. Yes. It’s like learning a different language. But, if you’re willing to commit to becoming proficient in these things, you will be successful. I don’t mean working on it one hour out of the week. It will take more work. Hiring expertise in this field could advance your timeline exponentially, but beware, there are a lot of smooth talkers out there who think they know the government space but don’t know how to sell.

If you’re willing to conquer these barriers, here is how your small business can successfully sell to the Federal government.

- Figure out who buys what you sell AND how they buy it.

- Communicate the value of your products and services, not your company’s set-aside status.

- Examine and get on contract vehicles that have a high propensity to offer the products you sell. Don’t just get on a contract vehicle like the GSA Schedule because of a company’s sales pitch.

- Build relationships. Reach out to buyers and small business specialists. Schedule capabilities briefs. Go to industry days and conferences. Seek out teaming partners.

- Do market research. Find out who your competitors are. Hint: They also might be a good teaming partner. Look at your competitors’ pricing to ensure your pricing is competitive. Look at who your competitors are connected to on LinkedIn. They may be good prospect contacts for you as well.

- Ensure you have strong relationships with financial institutions specializing in lending to government contractors. As Harvey MacKay said, “Dig you well before you’re thirsty.”

- Develop processes and systems that will keep you organized, including a good accounting system, CRM, project management suite, and other digital tools.

- Don’t give up when you don’t see results right away.

It’s no secret. It will take work. There is no easy button.

Doing Harder Better

Facing this challenging business sector can be very rewarding, especially when your other commercial revenues have decreased for whatever reason. I worked as a small business prime contractor to the government between 2004 and 2012. We could compete in the full and open market because we provided value, were organized, were well-funded, and, most notably, were RESPONSIVE TO OUR CUSTOMER. That is one thing we were able to do and do well. I think responsiveness is a significant differentiator; in my experience, small businesses excel at this in ALL business sectors. So, while there are barriers, there are also opportunities. One of my early mentors said, “If it were easy, everyone would do it.” Embracing hard usually means we can welcome more opportunities.

« Back to Blog Home